An increase of 30% in the amount of cod caught in the North Sea next year would still allow the stock to substantially increase in size, says the Shetland Fishermen’s Association.

And even under a doubling of the total allowable catch (TAC) for 2022, the cod stock would grow by 24%.

These are the conclusions of an analysis of figures produced by ICES in support of its official advice that next year’s North Sea cod TAC should be cut by more than 10%.

SFA executive officer Simon Collins said: “This illustrates perfectly the madness of doctrinaire interpretations of scientific output.

“The headline ICES advice of a 10% cut in the cod quota next year is based on the prediction that it will lead to a 53% increase in the stock size in 2023, to 75,000t.

“Yet a 30% increase – for example – would still result in a 42% increase in stock size to over 70,000t. That’s a difference of just 5,000t, or 7%, in the stock size, according to ICES. But opting for a cut instead of an increase would have a devastating effect on our fishing fleet.”

Simon Collins said this is primarily because North Sea cod quotas have already been slashed by 80% over two years, despite the fact that cod are highly abundant in Scottish waters.

“This is our most important whitefish catch, absolutely essential to business survival, and we are in a position here where even the scientists are telling us that increasing next year’s cod quota will not harm the stock. Politicians and fisheries managers must assume their responsibilities and do just that.”

In a paper setting out its argument in more detail, the SFA says that despite the harm a 10% cut in the TAC would do to the fishing industry, ICES’ own advice shows that it would have only negligible benefits for the cod stock compared to other, less damaging management options.

As is usual, ICES has provided advice on a wide range of potential management scenarios, ranging from a zero catch to a tripling of the TAC. This shows that there is a wide range of options available to fisheries managers, and that the differences between their outcomes are relatively small.

ICES predicts there will be almost 50,000t of mature cod (spawning stock biomass or SSB) in the North Sea in 2022. That is admittedly less cod than there has been in the past, but it would be substantially more than there is this year (38,000t). So ICES predicts that the North Sea cod stock will grow by 30% over the next year under current management measures.

“What then would be a good outcome for the North Sea cod stock – and the fishing industry – in the year after next?” asks the SFA.

“How about a further 30% increase in the stock size? ICES advice implies that the SSB of North Sea cod would grow by 30% in 2023 even if the TAC were increased by 77%.” (See table.)

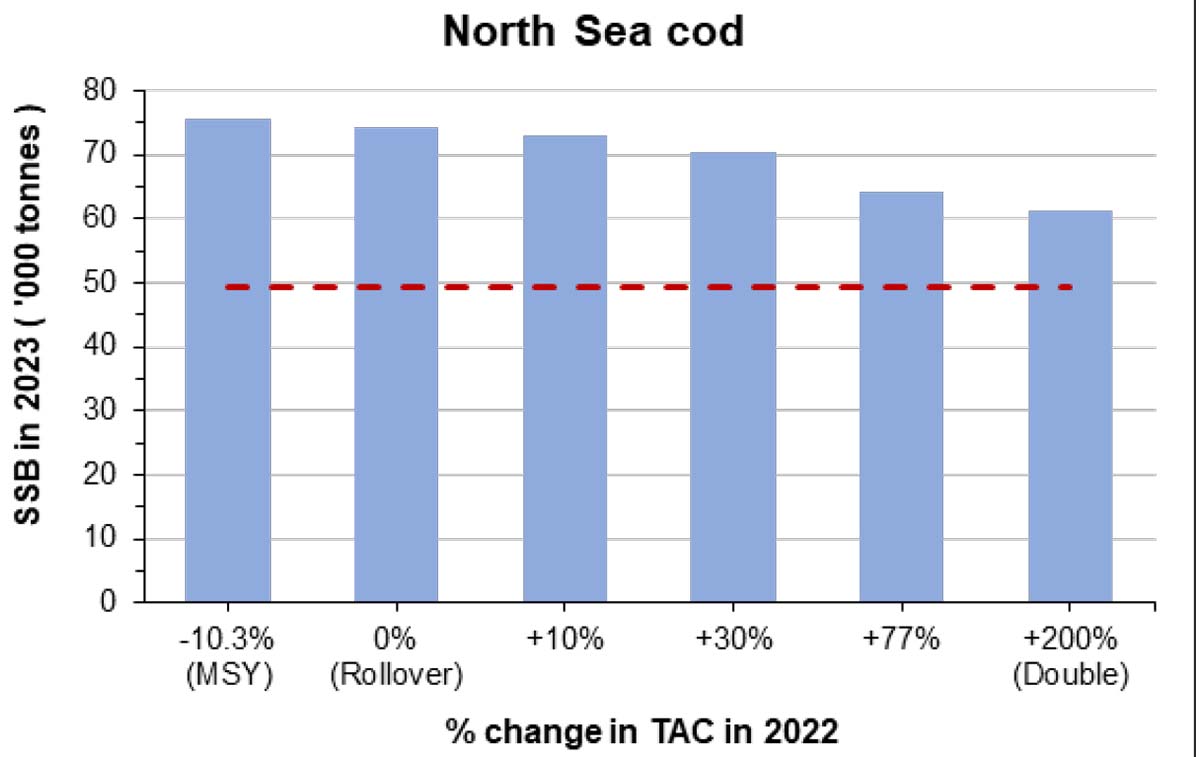

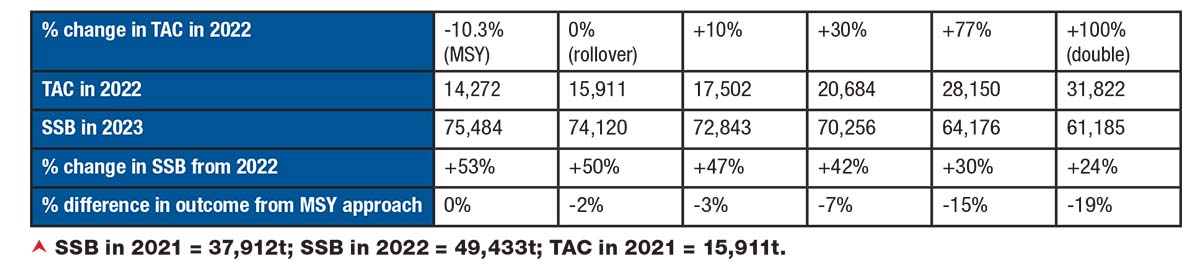

The spawning stock biomass of North Sea cod in 2023 predicted by ICES under various management scenarios, including the MSY approach (10.3% cut in TAC), rollover and various increases in TAC. The horizontal dashed line shows the estimated SSB in 2022.

In the case of a modest increase in next year’s cod quota, ICES predicts that a 30% increase in the TAC would result in a 43% increase in the stock size. A very modest 10% increase in the TAC would lead to a 47% increase in stock size. And a rollover of this year’s TAC would lead to a 50% increase in the stock size.

Even doubling next year’s TAC would still allow for a 24% increase in the size of the North Sea cod stock in 2023.

However, what ICES is advising for next year is a 10% cut in the cod quota, which it predicts will lead to a stock size in 2023 of 75,000t – a 53% increase.

The differences between the outcomes of the different management options are therefore very small. A 10% cut in the cod quota (as advised by ICES) would result in an SSB in 2023 of 75,484t, while a 10% increase in the quota would result in an SSB of 72,843t.

The difference between those outcomes is only 2,641t (3.5%), a negligible difference that lies well within the bounds of scientific uncertainty.

And the difference in outcome between ICES’ 10% cut and a 30% increase in TAC is still only about 5,000t (7%).

This story was taken from the latest issue of Fishing News. For more up-to-date and in-depth reports on the UK and Irish commercial fishing sector, subscribe to Fishing News here or buy the latest single issue for just £3.30 here.