Revisions to the economic link conditions saw increased landings of mackerel and herring by Scottish-registered pelagic vessels into Scotland in 2023, with more than 50% of their tonnage landed into Scotland.

The new conditions introduced on 1 January, 2023 cover eight key species – herring, mackerel, Nephrops, haddock, anglerfish, cod, hake and whiting – which together account for 90% of the value of total landings by Scottish vessels of quota species.

The new conditions required all over-10m Scottish vessels landing over 10t of the species to either land more than 55% of their cod, haddock, whiting, hake, anglerfish and Nephrops catches in 2023, or more

than 30% of their herring and mackerel catches in 2023, into a Scottish port. The required amounts of herring and mackerel increase to 55% by 2025.

Vessels failing to meet the link conditions must return quota in the following calendar year equivalent to 26% of the lost value to Scotland.

The economic link licence conditions were strengthened to ensure that vessels demonstrate a genuine economic link to Scotland.

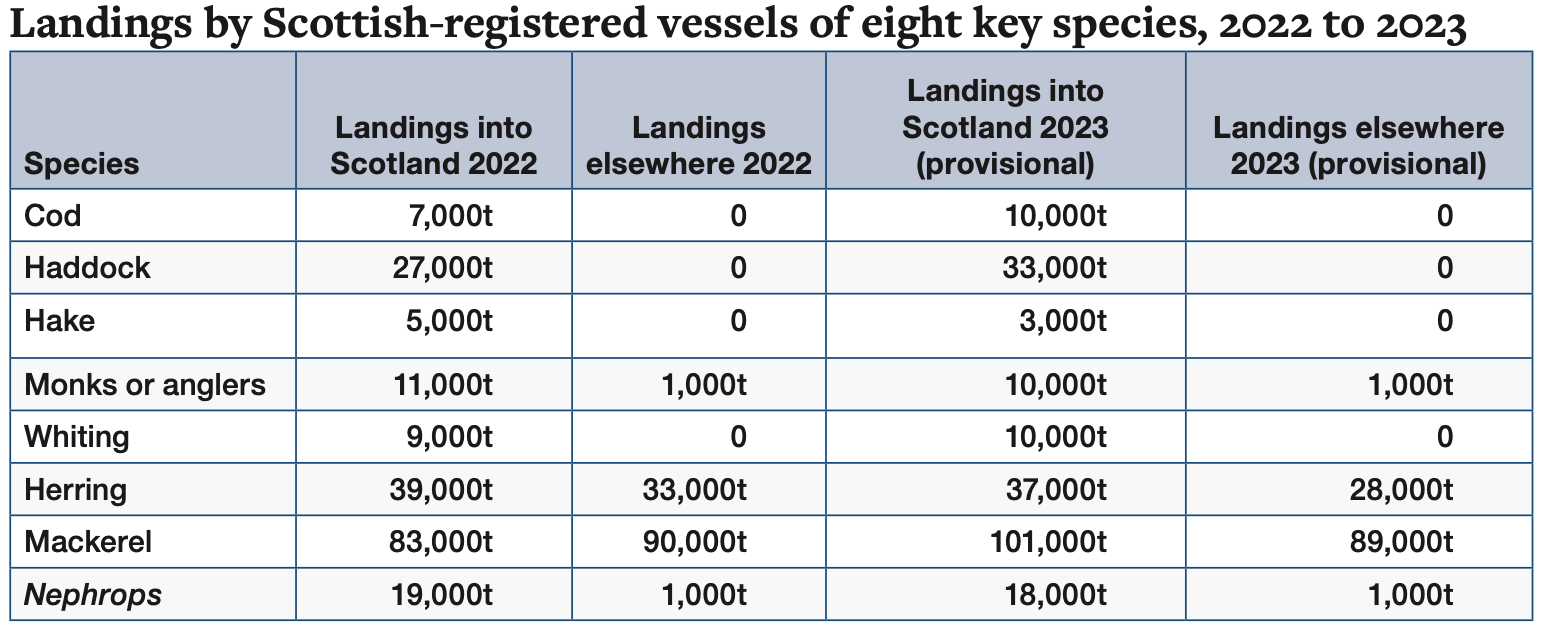

Figures for landings of the eight key species in 2023, with 2022 comparisons, are dominated by mackerel and herring, which accounted for 138,000t of the total of 222,000t of the key species landed into Scotland by Scottish vessels in 2023. Mackerel accounted for 101,000t and herring for 37,000t, while in third place was haddock with 33,000t.

Of the non-pelagic species, 90% of catches were landed into Scotland in 2023. Only small amounts of monkfish and Nephrops were landed outside of Scotland.

Landings of mackerel increased both into Scotland and elsewhere, while herring landings decreased both

into Scotland and elsewhere. Scotland’s Marine Directorate said the decrease in herring landings was primarily due to the decrease in the North Sea herring TAC in 2023. But despite the cut to the TAC, the share of landings of herring into Scotland increased relative to 2022.

The increase in mackerel landings occurred in both Shetland and Peterhead, the two major pelagic landing centres in Scotland. Almost 10,000t more were landed into Peterhead and around 8,000t more into Shetland – the latter a 42% increase compared with 2022.

Herring landings increased at Peterhead only, with decreases seen elsewhere in line with an overall drop in herring quota for Scottish vessels.

The bulk of mackerel and herring landings outside of Scotland were made into Norway, with some also going to Denmark. Mackerel landings by Scottish boats in Norway in 2023 were 80,000t worth £107m (77,000t worth £109m in 2022).

For herring, 27,000t were landed into Norway in 2023 worth £18m (32,000t worth £24m in 2022). Only 1,000t worth £1m were landed in Denmark, no change from 2022.

All the 2023 figures are provisional, and may change once the final sea fisheries statistics for 2023 are published later this year.

A Scottish government spokesperson told FN: “We welcome feedback from processors which shows that the policy change is delivering as intended. We plan to produce an evaluation of the policy change later this year once the full Sea Fisheries Statistics for 2023 are published.”

The Scottish Pelagic Processors’ Association (SPFA) welcomed the increase in pelagic landings into Scotland. Robert Duthie, chairman of the SPFA and managing director of Denholm Seafoods, told Fishing News: “We’ve made a massive investment in our pelagic facilities, as have other members of the SPFA.

“The Scottish pelagic processors have also got a bigger share of the Japanese markets now – we’ve gone from a very small share to above 20% – so yes, it’s good news.”

Two Scottish POs, the Shetland FPO and the Scottish Fishermen’s Organisation, which represent the bulk of the Scottish pelagic fleet, mounted a legal challenge to the new economic link conditions and sought a judicial review of the legislation. But the Court of Session rejected their challenge in April this year, and the POs decided not to appeal against the decision.

They said they were not against the principle of increased landings into Scotland, but argued that this needed an equivalent increase in processing and marketing capacity – otherwise the competitiveness of the pelagic sector would be devalued in a thriving international market.

This story was taken from the latest issue of Fishing News. For more up-to-date and in-depth reports on the UK and Irish commercial fishing sector, subscribe to Fishing News here or buy the latest single issue for just £3.30 here.

Sign up to Fishing News’ FREE e-newsletter here.

Main image credit: Ivan Reid