Twenty-five years after the last change to its levy – the charge paid to Seafish for the majority of seafish products landed or imported into the UK – the body has published its full response to an informal consultation on changes it is hoping to confirm next year and introduce in 2025.

This informal consultation, to gauge industry opinion, was undertaken in a bid to streamline the more formal consultation that will take place in 2024, before the final decision is taken by ministers.

Since they were last amended, inflation has eroded much of the value of the levy payments. The resulting financial pressures have inevitably included scaling back some activities undertaken by Seafish, including the controversial closure of the Hull Flume Tank, the only facility of its type in the UK at the time.

The Seafish 2023-2028 Corporate Plan, detailing the organisation’s priorities for the support of the seafood industry across the UK over the period, sets out a number of new or expanded activities it hopes to deliver in support of the seafood sector. Existing costs, currently running at £7.2m a year, are forecast to rise to over £9m due to inflation, but Seafish’s proposal is to increase income to £11m to allow it to undertake additional activities spread across the catching, processing and retail sectors.

Whilst the proposal to extend the levy to freshwater species makes sense – why should imported fillets of pangasius, one of the biggest-selling species in the UK, be exempt, for example? – this is impossible without a change to the 1981 legislation that created Seafish in the first place.

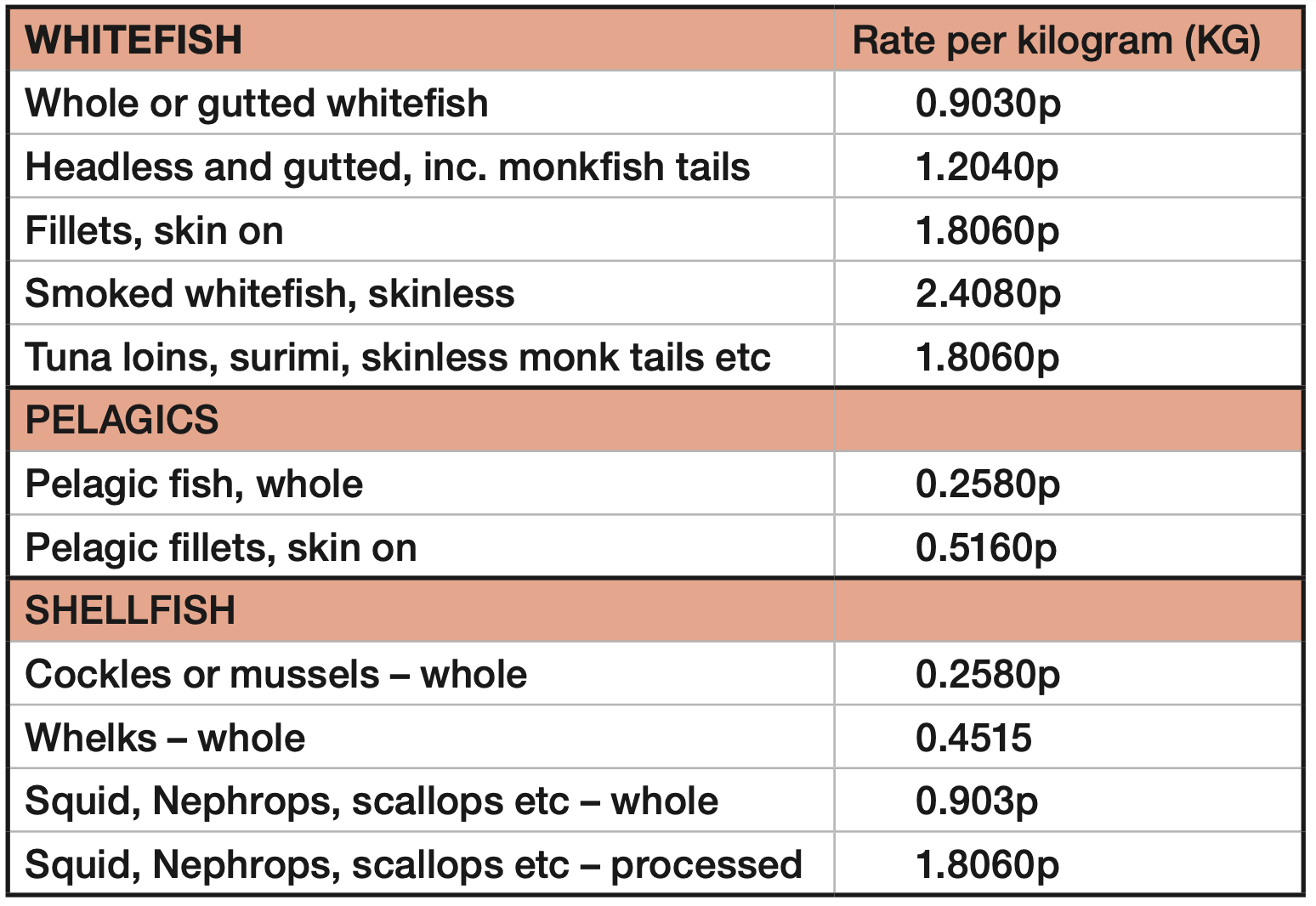

A summary of the current Seafish levies paid at first sale. The full range of current, and suggested, levies is available on the Seafish website.

The Seafish board, representing all strands of the seafood industry, from fishermen’s leaders though

to retailers and supermarkets, suggested a number of changes to the levy, including:

- A reduction in the proposed levy increase on pelagic species, cockles, whelks and mussels from 1p per kg to 0.5p per kg. The levy increase for pelagic species, cockles and mussels would be phased in over three years.

- Extending the levy to include imported canned, bottled and preserved species, which currently are exempt.

- A minimum levy threshold of £100 a year. It is estimated that 22% of businesses that currently pay the Seafish levy would benefit from this and would no longer need to pay the levy, reducing paperwork for the smaller players in the sector.

Perhaps the most contentious issue may be the proposal to include inflationary adjustment of 2% a year, to maintain the spending power of the increased levy. Many would argue that a successful shift to increase the volume of fish products sold to UK consumers – one of Seafish’s aims – by 2% a year would be a better target.

Mike Sheldon, chair of the Seafish board, said: “Seafish needs levy to operate. The last change to the levy was in 1999, and if rates had moved with inflation, then Seafish’s levy income would now be worth £16.8m. This equates to a reduction in our spending power of almost 55%, which is eroding our capacity to deliver the support the industry wants and needs.

“Based on feedback from the industry, we are proposing changes to the Seafish levy to ensure we can continue to deliver the valuable work we do to help the seafood industry to thrive.”

This story was taken from the latest issue of Fishing News. For more up-to-date and in-depth reports on the UK and Irish commercial fishing sector, subscribe to Fishing News here or buy the latest single issue for just £3.30 here.

Sign up to Fishing News’ FREE e-newsletter here.