The Irish seafood economy faced a ‘challenging’ year in 2023, with a 2.9% decline in its GDP from 2022 to a total value of €1.3bn, according to data in the Business of Seafood report from Bord Iascaigh Mhara (BIM). This was published in the

third week of September – later in the year than normal, with previous years’ reports coming out in the spring. This drew industry criticism, with Killybegs Fishermen’s Organisation

chief executive Dominic Rihan suggesting that there could be political reasons behind the delay in publishing figures that were likely to make ‘grim’ reading.

In its analysis of the figures, BIM said: “Brexit posed a significant challenge to the industry, reducing access to fish and

disrupting trade flows and market access. However, in response, there was an unprecedented level of government investment in the industry, demonstrating a strong commitment to the future growth and sustainability of the sector.

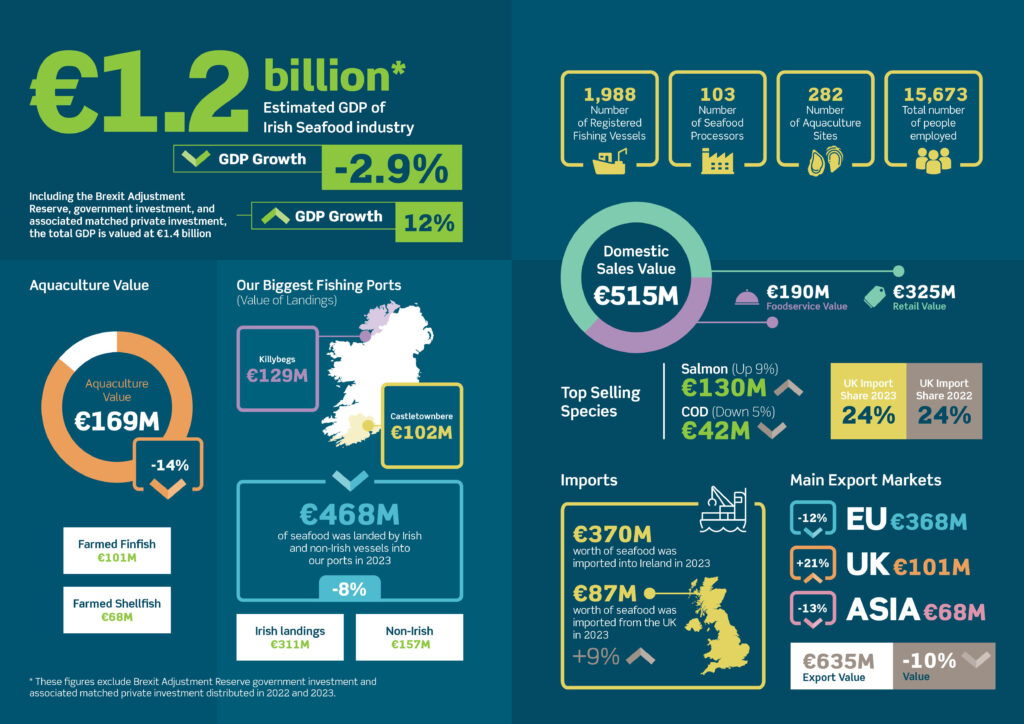

“This investment, combined with Brexit Adjustment Reserve funding, helped the sector achieve significant growth of 12%, bringing the total value to over €1.4bn, despite the initial decline of 2.9% in GDP from 2022, which valued the sector at €1.2bn.”

In 2023 there were 1,988 registered fishing vessels in Ireland – down by just five from 2022. The drop in vessel numbers in 2024 is likely to be much steeper, following last year’s major decommissioning round. Landings by Irish and foreign vessels into Irish ports were worth €468m in 2023, down 8% on 2022.

Consumption of seafood in Ireland in 2023 increased by 9% to €515m. The seafood foodservice sector grew by 13% to €189m – just 3% off its peak in 2019.

Key statistics for the Irish industry in 2023.

In addition to the quota reductions resulting from the Brexit TCA, factors identified by BIM as impacting the 2023 figures included reductions in foreign landings and biological issues in shellfish and salmon production. The sector also faced challenges from the cost of living crisis and high inflation.

CEO of BIM Caroline Bocquel said: “There is no doubt the global backdrop for 2023 has been very difficult for all industries, including the Irish seafood industry. The industry continues to weather the aftershocks of the UK’s exit from the European Union, a pandemic, inflation, record energy costs and ongoing impacts of the war in Ukraine.”

The report notes the difficult conditions faced by Ireland’s pelagic sector in 2023, with export volumes for key species such as blue whiting falling by 65% to a value of €14m. While there was strong growth in fishmeal and oils, lower quotas for horse mackerel and smaller blue whiting sizes heavily impacted the export value.

“Despite the challenges faced in 2023, the Irish seafood industry remains resilient and committed to sustainable growth in the future,” said Caroline Bocquel. “The investment made by the government in 2023 will result in increased opportunities for companies who now have one of the most modern seafood processing sectors in Europe, which we will start to see at the end of 2024 and into 2025.

“For the first time in four years, imports from the UK have not declined after the changes to trading brought about by the UK’s departure from the European Union, and sales of seafood in Ireland’s foodservice sector are almost back at pre-pandemic 2019 levels.”

This story was taken from the latest issue of Fishing News. For more up-to-date and in-depth reports on the UK and Irish commercial fishing sector, subscribe to Fishing News here or buy the latest single issue for just £3.50 here.

Sign up to Fishing News’ FREE e-newsletter here.

This story was taken from the latest issue of Fishing News. For more up-to-date and in-depth reports on the UK and Irish commercial fishing sector, subscribe to Fishing News here or buy the latest single issue for just £3.50 here.

Sign up to Fishing News’ FREE e-newsletter here.