The Chief executive of Welsh Fishermen’s Association lays out multiple issues threatening future of local fleet…

A combination of multiple factors – Covid, Brexit and the resulting export problems, fuel costs, the MCA under-15m safety code and medical certification requirements, and a continuing squeeze on fishing grounds – have left the Welsh industry struggling.

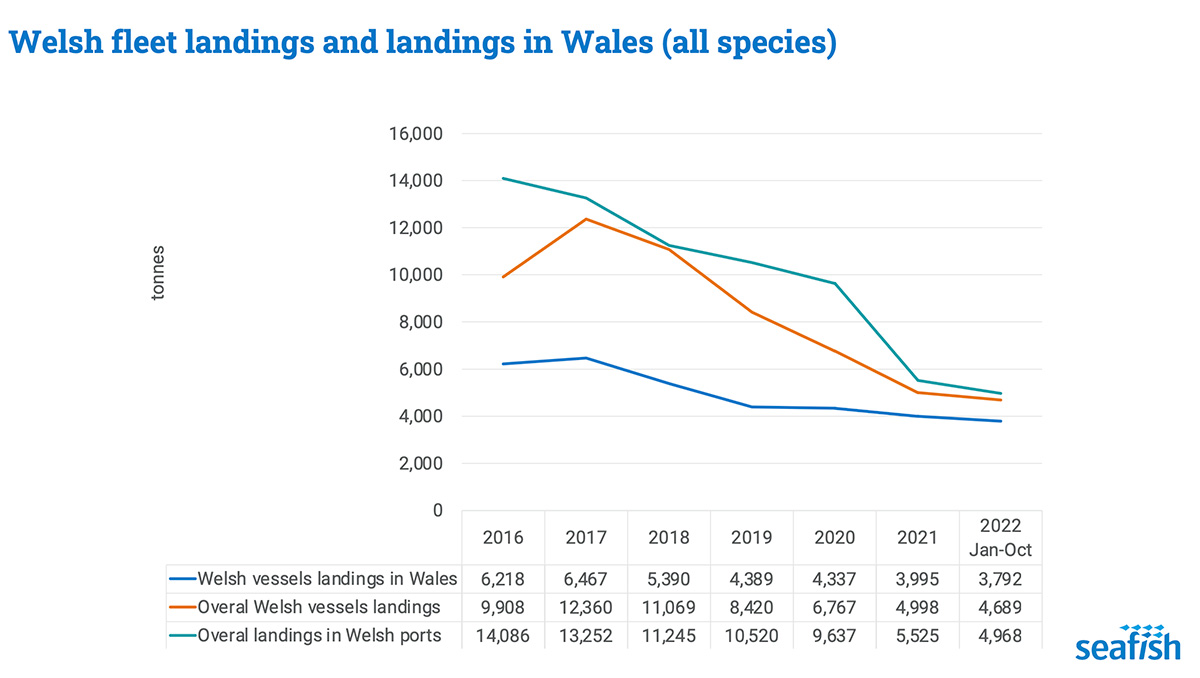

Landings figures to the end of 2022 show that Welsh landings have declined 75% by weight and 41% by value in the last decade.

“It’s been a long period of struggle – well, more survival than anything else. I don’t think I’ve ever known things to be so, well, desperate,” Jim Evans, chief executive of the Welsh Fishermen’s Association, told Fishing News.

“We have so many challenges in front of us it’s hard to have a clear path as to how we navigate those challenges.”

The reduction in weight and value of landings was mainly driven by the withdrawal of several over-40m mussel dredgers in 2021, but landings by under-40m vessels fell 42% in weight and 3% by value (18% accounting for inflation), and all sectors of the industry are suffering.

Around 90% of landings in Wales are of shellfish, headed by whelks and followed by king scallops, crab and lobster. Mussels dropped off the list following the loss of EU markets post-Brexit.

Brexit hit demand for other Welsh shellfish too. “For a lot of exporters, the costs, the paperwork and everything else make exporting challenging,” said Jim Evans.

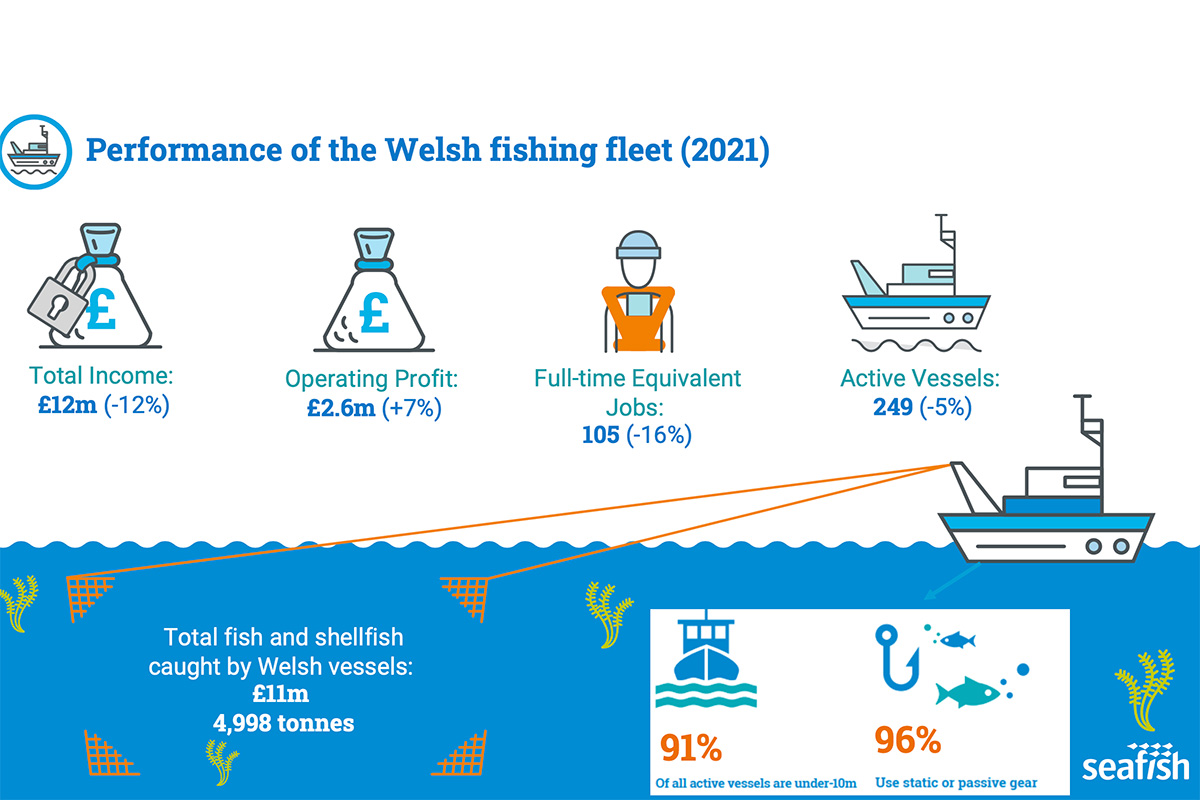

Key statistics for the Welsh fleet in 2021. (Graphics: Seafish)

He said the reduction in landings could be seen before Covid and Brexit, but had accelerated. Only 249 of 410 vessels on the Welsh register are currently active, the majority under 10m and working inshore.

Many owners may well have decided to pursue other activities until circumstances improve, he said. “The majority are single-handed, and quite a few of those would be seasonal, basically coming into the fishery for six months of the year.”

Recruitment into the industry and crewing are a problem in Wales, as in most of the UK. “There are some ideas as to how we develop a career path to attract young people into the industry, but the trouble is we’ve got higher-paid jobs, or with better conditions maybe, and we have to compete with that,” said Jim Evans.

Another major current concern, particularly for the small-boat fleet, is the new rules on medical certificates. “That’s probably the biggest issue, or the one that I get most feedback on at the moment,” he said.

“The good thing is that the industry as a whole is responding collaboratively to that challenge.

“Whether that changes our minister’s mind and how that is ultimately implemented by the MCA is another thing, but we’re all really committed to getting change, somehow.”

Jim Evans said that social and cultural changes were affecting the public’s perception of the industry and its role as a food supplier, and allowing environmental NGOs to dominate the headlines.

“A lot of coastal communities in Wales were built on fishing and herring – there was a strong maritime heritage – but with supermarkets and other factors, things have changed,” he said.

“The cultural change has created a distance between the public and their heritage – and I don’t mean long, long ago. Within my memory we used to depend on the seasonal fisheries. Low-carbon, high-protein food from the sea was a mainstay back then.

“But as the coastal communities have been eroded over the years and people buy from supermarkets instead of fishermen, that connection has gone.”

Jim Evans said there had been ‘a fair bit of interest’ in the £400,000 support scheme recently announced by the Welsh government. The scheme was welcome and might enable small-scale fishermen to add value to their catches, but it was not ‘the answer to everything’.

“It might make a difference, but you need to be able to fund the investments to start with before you can claim your 80% back.

“It wouldn’t replace the valuable role of the merchants. But I guess it gives people options to perhaps get more value out of their product rather than selling it in bulk, which is particularly important for small-boat guys.”

Glimmer of hope for Welsh mussel exports

Across the whole UK industry, the Welsh mussel fishery has fared worst as a result of Brexit. Producers geared up to the highly successful and well-established market in mainland Europe for live mussels saw their market slammed shut.

Welsh mussels suddenly required lengthy depuration before being allowed to be sold to EU consumers. This wasn’t feasible, and sales collapsed as a result.

James Wilson of Deepdock, one of several mussel producers around the Menai Straits to be hit, despite assurances to the contrary ahead of the Brexit deal, told FN that after a long period of zero exports, threatening the entire sector with closure, a limited route to export markets had finally been established, handing producers a lifeline.

This was through a lengthy process of confirming water quality standards, meaning that the EU no longer required mussels to be depurated before consumption.

“In the Menai East fishery area we now have Representative Monitoring Points distributed throughout the fishery order area. This season, one of these was deemed to have a sufficiently good sample dataset for it to be awarded a seasonal ‘A’ classification – so for the period October to April we have been allowed to export mussels from the production areas associated with this single monitoring point.

“It’s a great relief that we have had some opportunity to sell product – after two years when this has not been possible. But it’s from one small part of the fishery, so output has been limited. It is also entirely reliant on the monthly sample coming back within acceptable ranges, and because it’s time-limited, we are having to sell product when it’s not necessarily at its best, and so don’t get the best market price.

“It’s better than nothing, though we’re now confronted with a process without any certainty whatsoever. But if it hadn’t been for the positive engagement by our local Environmental Health Office, we would have been closed off out of the market entirely for the vast majority of the season, and as such would have all been out of business.”

This story was taken from the latest issue of Fishing News. For more up-to-date and in-depth reports on the UK and Irish commercial fishing sector, subscribe to Fishing News here or buy the latest single issue for just £3.30 here.

Sign up to Fishing News’ FREE e-newsletter here.